Expense Allocation

Expense Allocation: Establishing a Benchmark

Nicholas Molina

April 1, 2016

“A hedge fund hired us to investigate a claim of misallocation by one of its investors.” An industry consultant told us. “After a long and costly process, we discovered the investor was right; the hedge fund did over-allocate the expense in question. But we also discovered the hedge fund under-allocated other expenses and the investor ended up owing the firm money instead of the other way around.”

It is hard to understate the risks expense allocation poses to the alternative investment industry.

***

Before Dodd-Frank, expense allocation was an overlooked back office task that rarely provoked investor inquiry. As a result, when Dodd-Frank went into effect and new best practices were being established across the industry, expense allocation was neglected. That is, until now.

The SEC has brought six misallocation charges against private equity and hedge funds since 2014, and has stated expense allocation will be an investigative priority going forward. It is not surprising, then, to see the subject of expense allocation making its way out of the back office and onto the front page of the Wall Street Journal.

We surveyed industry leaders to establish a benchmark that helps identify expense allocation best practices and provides private advisors with a clearer picture of where they stand.

Who We Surveyed

Our survey focused on C-level executives, GCs and other senior managers with an overview of the firmwide expense allocation process. Correspondingly, CxOs are heavily represented in our survey (76.9%).

The survey includes both hedge funds and private equity firms, with a majority of responses being from private equity. This did not come as a surprise. Up until recently the SEC has charged more PE shops than hedge funds with misallocation. This, however, will start to change as the SEC Office of Compliance Inspections and Examinations (“OCIE”) stated that expense allocation will be an industry-wide investigative priority for 2016.

What best describes your role?

What best describes your firm?

Responses came from a diverse collection of firms ranging in size from under $1 Billion to over $20 Billion in assets under management. Most, however, were less than $5 Billion AUM, with a plurality being between $1 to $5 Billion AUM. Roughly correlating with AUM, the vast majority of firms managed less than 15 funds.

What size is your firm?

How many funds are managed by your firm?

Expense Allocation Survey Results

Key to performing expense allocation is knowing what can or cannot be expensed. This is usually codified in an expense allocation policy. It is critically important to have an up to date allocation policy as it will be the one of the first places the SEC will look during an investigation. Troublingly, nearly a quarter of respondents haven’t reviewed their policy in over a year – some didn’t have a policy at all. It is definitely a best practice to have a coherent expense allocation policy in place to guide your allocation process.

Our survey confirms that manual Excel based allocation dominates the industry. Unfortunately, Excel based processes are prone to errors and are notoriously difficult to audit. The respondents seem to hint at this later on in the survey.

Do you have an expense allocation policy? If yes, when was it last reviewed?

How are you performing expense allocation today?

We did not anticipate weekly allocations to be nearly 20% when 76.9% of respondents allocate manually. As you explore the data, however, this begins to make more sense as two thirds of firms who allocate weekly use a specialized software solution instead of Excel. Regardless, monthly allocations appear to be the standard and performing allocations on at least a monthly basis could be considered a best practice.

Rarely, it seems, do firms rely solely on the funds paying invoices directly. The vast majority of respondents have the management company pay some, if not all, invoices and the management company is then reimbursed by the funds. This helps explain why firms are performing expense allocations as quickly as possible, the sooner the expense is allocated the sooner they can get reimbursed.

How often do you perform expense allocations?

Who pays the vendor when expenses are allocated?

Professional expenses are nearly unanimously expensed to the funds (88.5%). Meanwhile, breakup fees or “dead deal” costs, which have been a sticky subject with the SEC (see KKR), were allocated by almost 60% of firms.

What types of expenses do you pass to the funds?

By far the most common allocation valuation is AUM or NAV, being used by 73% of all firms and by 90% of hedge funds. Interestingly, hedge funds are much more likely to utilize multiple allocation valuations (60%), whereas only a few private equity firms allocate based on more than one valuation (20%).

What valuations do you use as a part of your allocation method or process?

While we made the survey anonymous to solicit honest responses, we believe there may be some deception going on. When asked if they were confident in their expense allocation procedure 88.5%, or nearly all surveyed, answered Yes. However, when asked if expense allocation is a priority in 2016, a majority (61.5%) answered that improving expense allocation is a priority. If the expense allocation policy and procedure was already sound, one would expect the disagree or neutral responses to be higher. With the SEC lurking, we presume respondents might have been hesitant to indicate they weren’t confident in their expense allocation process. (We promise answers were completely anonymous.)

Do you agree with the following statement?: “We feel confident in our expense allocation policy, process and outcomes.”

Do you agree with the following statement?: “Improving expense allocation is a priority of ours in 2016”

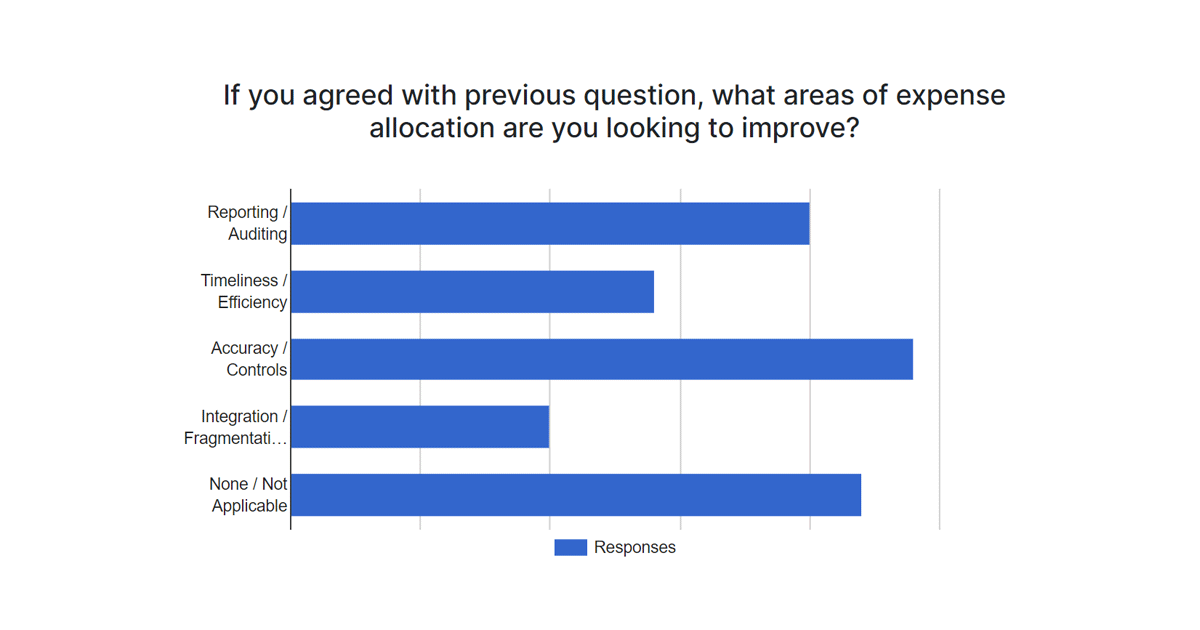

46% of respondents stated they would like to improve expense allocation accuracy and controls, another data point that appears to contradict the high confidence levels. Reporting and auditing was the second highest focus for improvement at 38%.

If you agreed with previous question, what areas of expense allocation are you looking to improve?

Conclusion & Recommendations

It seems clear the industry needs to improve the accuracy and auditability of their expense allocation process. Our conclusion isn’t based solely on our survey. The SEC claimed approximately half of private equity firms have deficient expense allocation procedures in place and noticed similar results across hedge funds. Excel based expense allocation is nearly ubiquitous, but is simply not secure and leaves the door open to mistakes that would require weeks of forensic analysis to correct.

Here’s our take:

First, review your allocation policy and ensure it is accurate and up to date. If you don’t have one, get one in place as soon as possible. You can’t allocate properly if you don’t know what you can or cannot allocate. We recommend hiring a law firm or specialized consultant to help if you don’t have inside counsel.

Second, start considering alternatives to Excel. Unfortunately, Excel is not reliable enough for complex fund or entity allocation and an excellent allocation policy is useless if it can’t be faithfully executed. Errors will happen in Excel and, when they do, it will be costly to correct them. Specialized expense allocation software can help you minimize the time and effort of audits or avoid costly SEC penalties.

We hope our survey was instructive in helping you benchmark your firm against the industry and identify operational strengths and areas for improvement.

Please let us know what you think or contact us if you have questions.

Tags

See Also

- IntegriDATA Exhibiting at 2016 Private Equity CFOs and COOs Forum

- A Cautionary Tale of Wire Fraud

- Hedge Funds Achieve Cash Payment Automation as IntegriDATA’s CashWire Integrates With SWIFT Gateway Provider

- IntegriDATA Announces Major Upgrade to Collateral Management System

- Finance depends too much on Excel. It’s time to change that.